Deal or No Deal

Examining Shifts in Acquisitions and Divestitures in the MedTech Industry

The past five years have been shaped by major macroeconomic and geopolitical shifts, COVID-19, fluctuating interest rates, a pivot from growth to profitability, digital disruption, evolving global politics, government cuts and tariffs. These forces have shaped and/or will continue to shape mergers, acquisitions and divestiture activity in MedTech, notably:

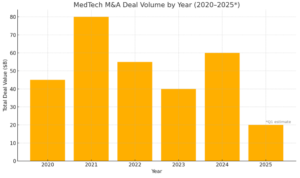

- 2020: COVID all but froze the M&A landscape with some notable exceptions.

- 2021: There was an uptick in M&A driven by access to cheap capital and investments in digital targets.

- 2022: Continued focus on digital with a notable uptick in robotics acquisitions but an overall decline due to higher interest rates starting to dampen enthusiasm.

- 2023: Margin over growth becomes a major priority which further reduced interest in M&A.

- 2024: There was an M&A rebound with focused deals, but with continued emphasis on improving margins while companies continue to struggle with labor and material cost pressures. Declining valuations also made the market more attractive.

- 2025: Despite promising early indicators for MedTech M&A in 2025, fueled by lower rates and digital pivots, tariffs and economic uncertainty are fostering caution and complicating M&A forecasts. While acquisitions should persist, a near-term deceleration or focus on domestic manufacturers seems probable.

As shown in Figure 1, the deal volume mirrors these trends, with clear surges and pullbacks corresponding to macroeconomic pressures.

The table below shows many of the major deals over the past five years, but by no means covers the entire market and is included to help give context.

Table 1: Example Large Acquisitions and Divestitures from Past 5 Years

| Year | Acquirer | Target | Value ($B) | Top Motivation |

|---|---|---|---|---|

2020 | Siemens Healthineers | Varian | 16.4 | Expand oncology treatment portfolio and imaging integration |

2020 | Teladoc | Livongo | 18.5 | Capitalize on virtual care and chronic disease management post-COVID |

2021 | Baxter | Hillrom | 12.4 | Strengthen hospital connectivity and digital health solutions |

2021 | Boston Scientific | Lumenis Surgical | 1.1 | Enhance surgical laser technology offering |

2021 | Philips | BioTelemetry | 2.8 | Grow in remote cardiac diagnostics and monitoring |

2021 | STERIS | Cantel Medical | 4.6 | Expand infection prevention and dental sterilization segment |

2022 | J&J | Abiomed | 16.6 | Broaden cardiovascular treatment, including heart pumps |

2022 | Stryker | Vocera | 3.1 | Improve clinical communication and digital workflow tools |

2023 | Smith+Nephew | Engage Surgical | 0.14 | Add robotic-enabled partial knee replacement capability |

2023 | GE Healthcare | Spin-off Completion | N/A | Create independent imaging-focused company for investor clarity |

2024 | Boston Scientific | Axonics | 3.7 | Gain presence in neurostimulation market (urology, incontinence) |

2024 | Thermo Fisher | OMNI Life Science | 13.6 | Expand transplant diagnostics platform |

2024 | Stryker | SERF SAS | 0.25 | Strengthen orthopedic implant offering in Europe |

2024 | J&J | Shockwave Medical | 13.1 | Expand cardiovascular portfolio with innovative lithotripsy tech |

2025 | Divestiture of: Medtronic Patient Monitoring and Respiratory | TO: Carlyle | 7.1 | Refocus on core business, exit underperforming segments |

Relevance to Digital Thread

As companies reignite spending in MedTech M&A there are critical needs to think through the impact of the digital thread.

In general, having a well-implemented set of digital thread capabilities that support multiple (and potentially diverse) divisions, while maintaining highly harmonized processes with necessary flexibility, enables new acquisitions to be onboarded and integrated rapidly into the broader business.

Best-in-class companies have dedicated onboarding teams and a playbook for major incorporating new divisions into digital thread platforms. They can quickly, and in some cases, concurrently onboard acquisitions or integrate divisions that have not yet been aligned with the broader digital thread ecosystem. Mature systems allow for continued protection of highly sensitive IP while opening new opportunities for collaboration, kitting and better platform strategies.

Beyond this general approach, the nature of mergers, acquisitions and divestiture activities warrants yet further consideration depending on the scenario. The following scenarios describe some different acquisition or divestiture types and how the digital thread may be used to further attain the desired business outcome that was promised by the investment:

Scenario 1: Digital (or other Innovative) Expansion

In this scenario more traditional MedTech companies incorporate digital targets (or other similarly innovative companies) and ideally integrate these new capabilities into their business. In the previous blog articles on MedTech industry trends, we discussed the explosion of digital health and how it creates considerable revenue opportunity over “base business”. Specifically, we showed how the MedTech industry is likely to grow to around one-trillion USD by the early to mid-2030s (from ~600 Bn in 2024), but the expansion into related digital services opens what we estimated as a three-trillion USD global market, much of which creates exciting and compelling new revenue opportunities for the sector*.

How Digital Thread Facilitates Business Outcomes

Companies with a strong digital thread strategy have developed a solution that integrates traditional hardware with software and AI solutions to allow for global collaboration, new product innovation, and manufacturing flexibility.

Key Digital Thread Capabilities Should Include:

- Collaborative Product Ideation and Kitting (mixing traditional and digital product types)

- Closed Loop Integration of Real-World-Evidence supported by Product Lifecycle Management (PLM), Quality Management Systems (QMS), Internet of Medical Things (IoMT)

- Multi-Level Requirements, Risk and Test supported by Systems Engineering

- Configuration and Variant Management and Integrated Product Development supported by Systems Engineering, Application Lifecycle Management (ALM), and PLM

- Flexible Process Engineering and Manufacturing Design Approaches supported by Product Lifecycle Management Manufacturing Process Planning tightly Integrated to Enterprise Resource Planning and Manufacturing Execution Systems (MES)

- Plant Automation

- Industrial Data Operations

- Flexible Supply Chain Capabilities

- Global Field Operations integrated to IoMT, AI and software-driven devices.

Beyond the digital thread there are often significant organizational alignment activities that must occur. Often the new “digital organization” is familiar with an agile way of working which might be a foreign concept to the traditional MedTech organization. On the other hand, the acquired company may not understand how to deal with more complex regulatory scenarios, especially globally, or how to manufacture and deliver at scale.

The digital thread program can act as a catalyst not only for automation but also for organizational alignment and cross-learning. Appointing global capabilities leads can have the accountability not just for common systems, but also processes, and organizational constructs (people) to make lasting and integrated changes.

Scenario 2: Broaden Treatment within Segment

In this scenario, MedTech companies are seeking to broaden treatment options into a given segment and have made an acquisition to help fill the gap.

How Digital Thread Facilitates Business Outcomes

Many small to mid-size acquisitions that often fill this scenario lack digital thread maturity which poses several challenges.

- Risk to the Promise of Scale: While there is capital available from the acquirer to enhance the acquired company, grow sales and add talent, the growth desired may be stinted by the digital scalability of the organization. A digital thread platform or set of platforms, especially in areas like PLM, QMS, MES, supply chain and manufacturing automation are key to enable growth.

- Risk of Compliance and Quality Issues: Introducing a new entity may create compliance risk as it becomes part of a bigger target for regulatory authorities. In addition, the organization may be funded to scale but isn't set up to be compliant. In this scenario it’s imperative that basic quality and compliance, especially those areas covered by ISO-13485:2016 and Part 820, are well controlled by Systems Engineering, PLM, MES and others. These are the foundational systems that also form the digital thread.

Scenario 3: Divestiture to Create Focus (e.g. to more profitable segments)

In this third scenario the MedTech company chooses to divest part of the business to create focus and strong competence for the rest of the business.

How Digital Thread Facilitates Business Outcomes

In this scenario several things tend to happen:

- Divestiture Acts as a Catalyst for Change: The divested company needs to split out data and systems from current digital platforms, but are often seeking not to just duplicate but use available deal capital and/or separation mandates to fund a new digital platform which is narrower in product scope. This can be a great opportunity for long-lasting improvements with a more focused product footprint.

- Need for Continued Collaboration Between Now-Separated Parties: In some cases, there is a continued need for tight collaboration and partnership between what is now two organizations. Both companies benefit from having a digital thread with a data orchestration and collaboration layer in between. This sounds simple on paper but in reality, can be hard to do. For example, coordinating engineering change management between two entities without adding bureaucracy can be challenging. A digital thread creates a foundation to ease the pain, but the effort still needs to be well understood by all parties and detailed strategy development based on best practices is critical.

Scenario 4: Geographic Expansion

In this fourth scenario, a MedTech company acquires a regional player to gain regulatory clearance, market access, or channel strength in a new geography. These acquisitions often bring operational complexity due to local regulatory requirements, different documentation standards and disparate IT ecosystems.

How Digital Thread Facilitates Business Outcomes

Best-in-class companies have dedicated onboarding teams and a playbook for incorporating new divisions into their digital thread platforms. This capability allows the acquiring company to leverage the acquired organization's regional expertise to accelerate approvals and market entry.

In parallel, integrated digital manufacturing and supply chain platforms create the flexibility to design and manufacture anywhere. Tools like manufacturing process planning, manufacturing BOMs, and connected supply chain systems make it easier to shift production across geographies, adapt to local requirements, and optimize distribution. Without these capabilities, transferring design intent and validation to a new location becomes significantly more time consuming and error prone.

**To understand how a figure of three trillion is reached, consider that the current digital health market is $250 billion+. With a projected Compound Annual Growth Rate (CAGR) of close to 20% expected to continue for the next 10 years, this explains the significant growth.This is incremental to the anticipated growth of base MedTech business, which is currently achieving global revenues of $600bn growing at a CAGR of approximately 6% resulting in a $1tn industry by 2035. Combining traditional MedTech with digital health gives approximately $3TN in revenue opportunities for the MedTech industry. The ability to claim part of this market will be directly correlated with a company’s investment in a digital thread which supports connected, software and AI driven offerings.

Looking Ahead

As we move further into 2025 and beyond, several forces are poised to shape the next wave of mergers, acquisitions, and divestitures in MedTech. While uncertainty remains, especially around geopolitical tensions, tariffs and interest rates, early indicators point to a market that is cautiously optimistic and increasingly strategic.

Key Trends Likely to Define the Next 12–24 Months

1. Acceleration of Portfolio Rebalancing: MedTech companies will likely continue refining their portfolios, divesting legacy or lower-growth segments to sharpen focus on scalable, tech-enabled offerings. This creates new opportunities for private equity and carve-out specialists to reimagine these spun-off businesses.

Watch for: More divestitures from large strategics like Medtronic, BD and Philips, with reinvestment into AI, robotics and cloud-connected therapies.

2. AI and Smart Devices as Acquisition Catalysts: With the emergence of foundation models, generative AI, agentic AI and real-time data integration across smart devices, acquisition targets that enable intelligent automation, clinical decision support, EHR integration, and patient engagement will become highly attractive.

Watch for: Mid-size AI and software startups being bought for capabilities rather than cash flow—especially in diagnostics, remote care, telemedicine, and surgical robotics.

3. Rise of “Platform Thinking”: Buyers will increasingly seek platforms, not just products. Acquisitions will focus on companies with proven digital and operational infrastructures that can be extended across multiple product lines or geographies.

Watch for: Consolidators that are set up to rapidly onboard targets into a globally integrated ALM, PLM, QMS connected platform to reduce onboarding friction and enable faster synergy capture.

4. Cross-Sector Convergence: Boundaries between MedTech, Biotech, Pharma, and Healthcare are continuing to blur driven by digital. Expect more deals at the intersections—where device makers add data layers, diagnostics companies buy digital apps, and surgical companies move into therapeutics.

Watch for: Strategic partnerships and M&A moves involving cloud providers, health insurers, and big consumer tech firms aiming to stake a claim in healthcare ecosystems.

5. Tariff Related Acquisitions and Divestitures: As mentioned at the beginning of the article, it seems likely that tariffs will likely impact MedTech M&A negatively in the short term. But it’s also possible that companies seek to increase their footprint of domestic manufacturing or sell-off international locations.

Watch for: Companies seeking larger domestic manufacturing footprints, trade policies and sub-sector impacts.

If you found this article insightful and want to dive deeper in the MedTech industry trends and, check out our compendium where we explore technological trends in MedTech Industry.