Innovation Portfolio Rationalization in the Face of a Downturn

10 Practical Tips to Rapidly Right Size Your Innovation Portfolio

Kalypso is a people business. We don’t have manufacturing plants or production lines, but we do have industry expertise and a deep bench of thought leaders. To meet this moment, we’re doing the one thing we can: capture what we know and share it. We hope you find this article useful as you think about what you can do to reduce your risks today and prepare for the future.

Rarely has the future been more uncertain. As an extended economic downturn looms and unemployment rises, many companies will miss their guidance as demand for products and services slows and supply chain challenges persist. Now is the time to act fast, make the required strategy changes, and thoughtfully rationalize and rebalance your innovation portfolio.

Even in a strong economy, leading companies have learned that they need to continually monitor and rebalance their innovation portfolios, pruning low value projects in favor of accelerating the most promising. The pace of change has accelerated well beyond the point where an annual evaluation of investment allocation and project priorities is enough.

Portfolio Rationalization Basics

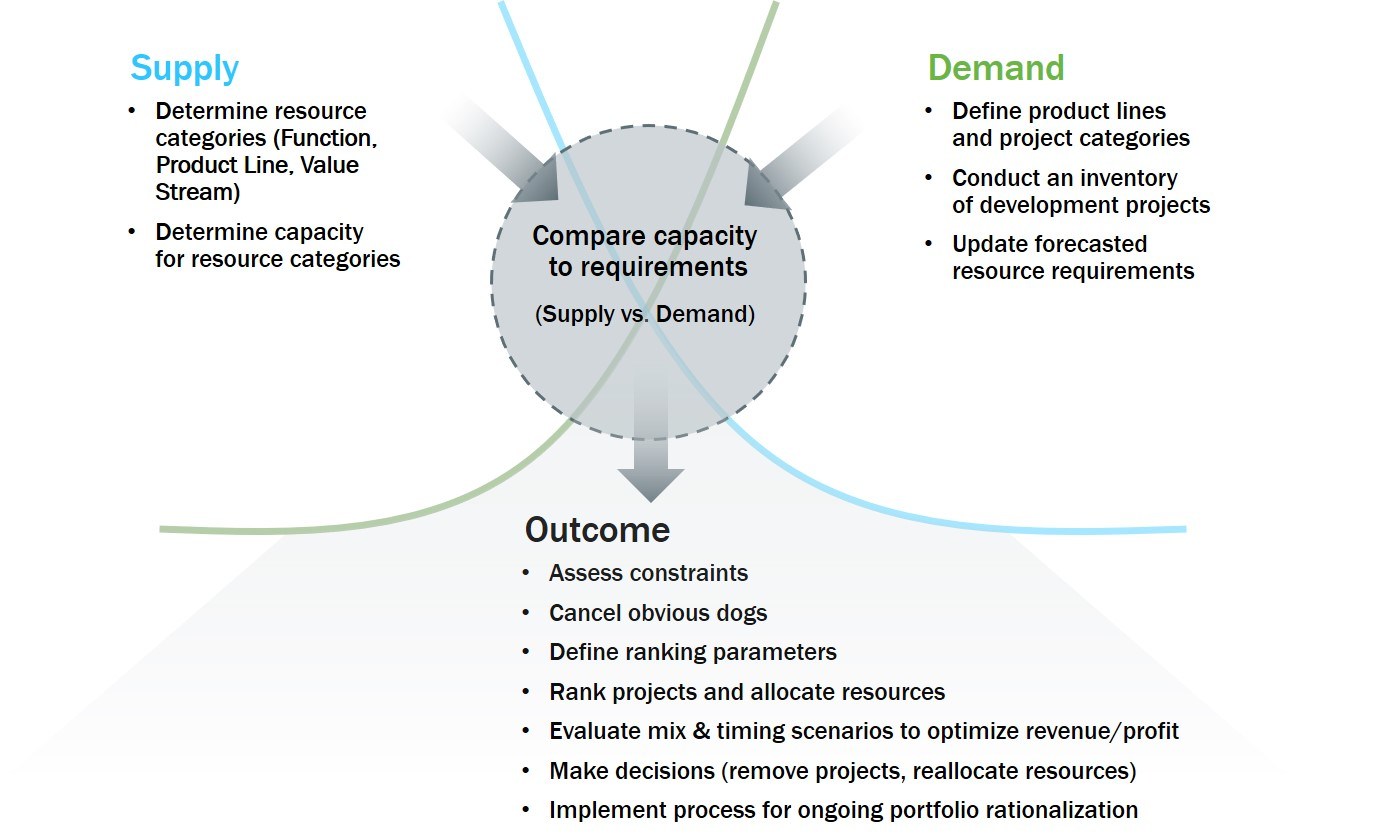

In its simplest form, innovation portfolio rationalization starts out by determining development capacity for each resource category (e.g., function, product line, value stream). This ‘hard ceiling’ represents the supply side of the equation. On the demand side, you conduct an inventory of all development projects and update forecasted resource requirements for each. At this point, you compare capacity to aggregate requirements (supply vs. demand) and assess constraints in the near, medium, and long term.

The next step is to cancel all obvious dogs (pet projects, science experiments, projects without validated customer value or that don’t clear a minimum financial threshold). Prioritize the remaining projects using a simple and intuitive set of ranking criteria or a scoring methodology that reflects your go-forward strategy. Resources are then allocated to projects according to their ranking until the new resource constraints are reached.

Along the way, evaluate the mix and timing of projects to optimize revenue and/or profit from new products. Companies with advanced portfolio management capabilities and centrally housed project data can quickly model or simulate alternative scenarios and timing of projects. Finally, you make the tough cut decisions and take action to implement.

Ten Practical Tips to Rapidly (In Days, Not Weeks) Right Size Your Innovation Portfolio

1. Decentralize decision making

Corporate leaders establish company-wide business strategy, but portfolio rationalization needs to happen at the level in which resource allocation decisions are made. This is at the business unit level for most large corporations (you can read more about portfolio hierarchy in large corporations here). Business unit leaders are closest to the markets their product lines serve and can more readily adapt to changes in customer needs and buying patterns.

2. Revisit your innovation strategy

Where you play and how you win with innovation has likely changed. Start with a scenario-based assessment of the new normal. Agree on a time horizon, talk to your largest customers, assess the macro and micro economic impact and health of your target markets, and project a best-case and worst-case recovery timeline. Determine which market changes will be temporary and which will remain after a recovery.

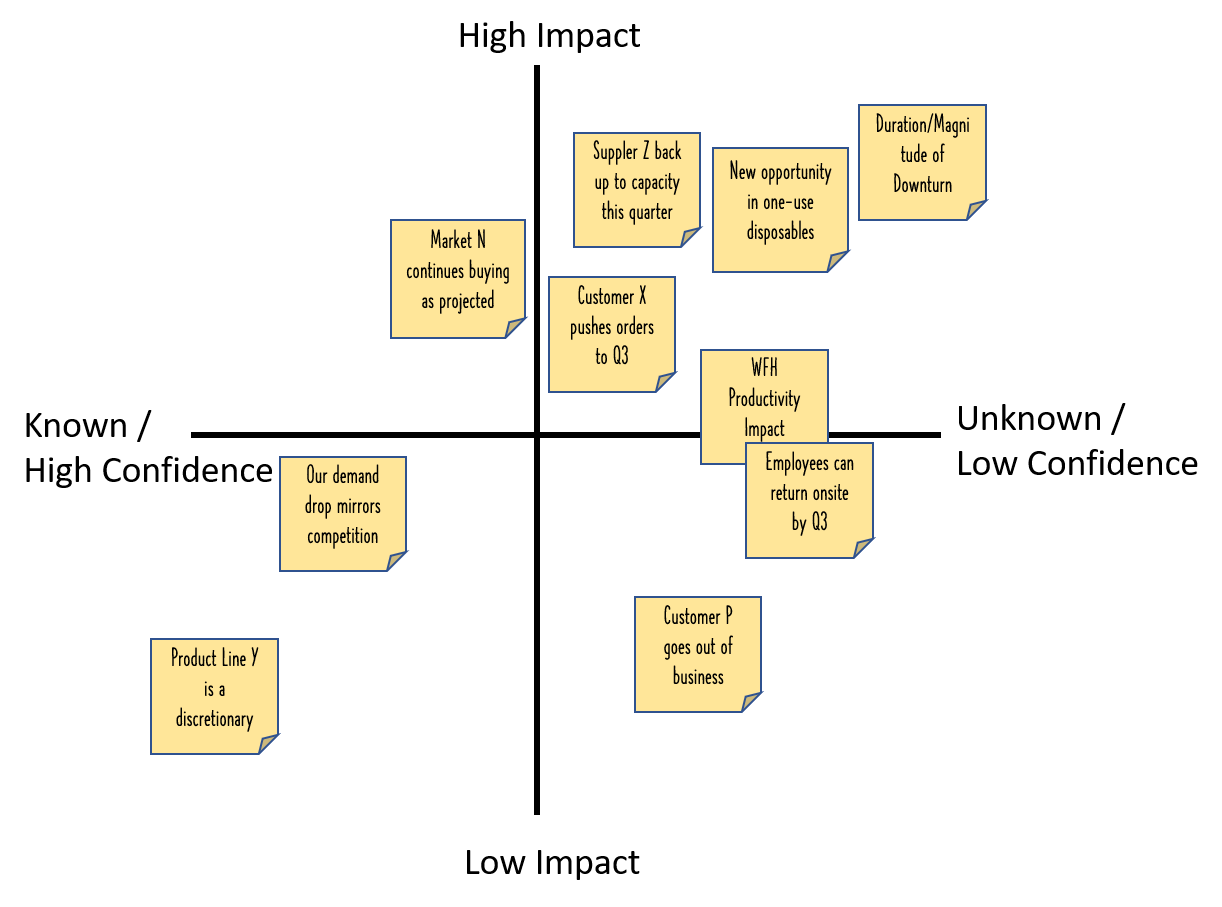

We are not talking about a multiple week, consensus building exercise here; we are talking about days. You’ll need to be comfortable making decisions with countless economic unknowns. Capture your scenario assumptions and quickly prioritize them on a 2X2 grid by using low to high impact on one axis and known to unknown on the other (shout out to Brant Cooper, author of The Lean Entrepreneur for this idea). Use the grid to identify the riskiest assumptions to monitor (highest impact and most unknown) and then move on.

Once you’ve completed this rapid market assessment, it’s time to revisit your innovation strategy. Your innovation strategy and resulting portfolio objectives need to be revised and communicated to the organization. Your investment mix, financial targets, and market needs need to be re-examined using a lens that is different from the one you used two months ago.

Here is a list of questions to get you started:

- How should we change our investment mix across cost reduction, defensive (customer retention), and growth project categories? Across derivative, new, and platform projects?

- How has the portfolio’s market risk changed? Should we consider a lower risk/return ratio while waiting for demand signals to improve?

- What is the gap between the portfolio’s new risk-adjusted revenue and our near and longer-term plans? Do we need to revise our revenue targets?

- How has the downturn impacted our target opportunity areas? Does our portfolio still address critical unmet needs in our target markets, or do we need to pivot?

- How is work-from-home impacting our key strategic programs?

- Have any new opportunity areas opened up? Are there new customers, new services, or new channels to pursue?

- Are there projects we should immediately accelerate, decelerate, or kill?

- Do we need to adjust the timing of our investment in feasibility or exploratory work?

3. Avoid ‘death by a thousand cuts’

Reduce development capacity more than you think you have to, so you don’t have to reduce again next quarter. Your project teams will lose productivity and will be ineffective if they are waiting for another shoe to drop.

Also, try to avoid putting projects ‘on hold.’ Either classify projects as approved and funded or cancel them. ‘On hold’ projects have an uncanny ability to attract resources as well-meaning employees keep them on life support behind the scenes.

4. Clean out the zombie projects

Every company has room to free up resources that are working on questionable projects. These can be:

- Unapproved pet projects

- Approved pet projects

- Projects that were killed or put on hold that don’t seem to go away (aka, zombie projects)

- Dormant projects that seem to languish without visible progress

- Incremental improvement projects that start as a one-off field request but don’t move the business needle

- Science projects without a home (i.e., not linked to the product line roadmap)

If any of these sounds familiar, now is the time to clean them out once and for all. Even in normal times, you need to periodically clean these dogs out of your pipeline.

5. Reset project projections and apply a market risk adjustment

Update new product schedules and volume projections to reflect the new reality and apply a weighted risk reduction to projected revenue consistent with customer segments that are being hardest hit - those products that rely on discretionary spending, in-person activity, or consumer travel. For example, medical device companies that supply products for elective surgeries have been especially hard hit. However, they expect a bolus of demand once pandemic conditions improve. What does this mean for the volume projections on next generation products in the development pipeline?

6. Avoid forced rankings

Instead of forced ranking projects from one to ‘n’, assign projects to one of three or four tiers. The decision on whether a project falls into an ‘A’, ‘B’, or ‘C’ tier is simpler and much quicker than a long, drawn out debate to determine if a project should be number 14 or 15 on a list of 100 projects. If your new ‘cut line’ falls at the top of the ‘C’ tier, there is no use debating the ranking of projects in the ‘A’ and ‘B’ categories.

No matter if you use financial criteria, scoring models, sophisticated Monte Carlo analysis, or customer evidence metrics, the value is in the prioritization discussion. Accept that you are making decisions under uncertain conditions. There is no magic algorithm. The data helps guide the decision makers, but it doesn’t give them the answer.

7. Ignore sunk costs

By definition, a sunk project cost cannot be recovered and is irrelevant to the portfolio rationalization decision. This is not the time to be emotionally bound to a questionable project because you’ve invested to get it this far. If it doesn’t make the cut, capture key learnings and reusable design elements and move on.

8. Don’t cut too deep in your bottleneck function

Most companies have a chronic bottleneck function, role, or skillset that is a root contributor to project schedule slips that can slow the entire development pipeline. Find the bottleneck in your company and be careful not to cut too deep there. It’s typically a shared function that has one person spread across multiple projects. Here’s a hint - it’s not always Engineering or R&D. It’s often Quality, Regulatory Affairs, or Manufacturing. Development productivity and throughput will be limited by the most overloaded function.

9. Don’t throw out the new-growth baby with the bathwater

While relentless focus on the core business and near-term revenue generation is the priority for surviving a crisis, it is important to do so without completely mortgaging your future. Cutting too far back on new-growth projects can leave an insurmountable gap when economic conditions improve. Many businesses started, scaled, or made bold investments that accelerated their growth during recessionary times, including Apple, AirBnB, Square, Uber, Pinterest, Adobe, and Amazon Marketplace. Rather than cancelling new-growth projects altogether, you can use metered funding to continue low cost experiments on the highest impact, highest risk assumptions for your most promising opportunities. While the investment balance between core and new-growth innovation will change, it still needs to be an ‘and’ and not an ‘either/or.’

10. Over-communicate

Err on the side of over-communicating to your employees throughout the portfolio rationalization process. Consider a weekly communication where you can explain changes to innovation strategy, project priorities, and resource re-allocations in addition to answering questions. Be transparent about the portfolio changes you are making and explain the ‘Why?’ Remind your employees that you are all in this together to get through the downturn. This is especially important while they are working from home. Most importantly, ask for their input, they will have good ideas you didn’t think of.

Note that these tips are just as applicable to other initiatives that consume scarce resources, including IT projects, operational efficiency improvements, and projects that address supply chain vulnerabilities.

Moving Forward

Portfolio rationalization is not a one and done exercise. Leading companies have a process for ongoing resource management - in good times and bad - that provides decision makers with the information necessary to continuously fund the right number of projects (resource demand) relative to capacity (resource supply).

This crisis has already had an unprecedented effect on the economy. Corporate leaders are experiencing volatility and uncertainty like never before. At some point, the pandemic will end, and business will start to pick back up. Acting now to rationalize and rebalance your innovation portfolio will help you survive the recession and leave you prepared to win when good times return.