Innovation Budget Challenges: Part 1: Avoiding the Cost Cutting Game

In today’s demanding business climate, fiscal growth can be hard to come by. Competition is fierce, methods of consumption are changing, digital technologies are disrupting the way we do business and uncertainty in global markets is shrinking expected cash flow. With constant pressure to increase profits, companies are looking at cost cutting as their saving grace to bring about growth beyond the single digits.

We’re seeing this across industries – companies that were built on innovation and brand leadership are now succumbing to the pressures of the market and turning towards acquisitions, spin-offs, and lately, cost cutting initiatives.

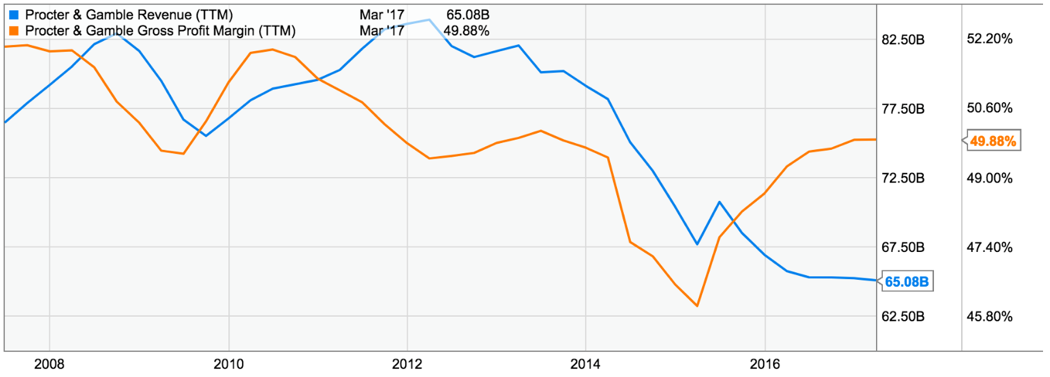

Consumer goods giant Procter & Gamble was built on innovation in R&D and marketing, with brands including Tide, Gillette and Pampers, among many others. Feeling the weight of the Recession of the late 2000’s, P&G began what has now been almost a decade of cost cutting imperatives – a zero overhead growth (ZOG) policy in 20081, huge headcount reductions in 2012 and 20132 and a cumulative $7.2 billion in savings from 2012-2016 through brand divestitures, supply chain restructuring, and cuts in marketing expenses3. Over this “slimming down” period, P&G kept profit margins fairly steady. Recently, P&G has seen significant increases in gross profit, but a lack of focus on top-line growth has led to a continuous decline in revenue.

Figure 1: Proctor & Gamble Revenue vs. Gross Profit Margin4

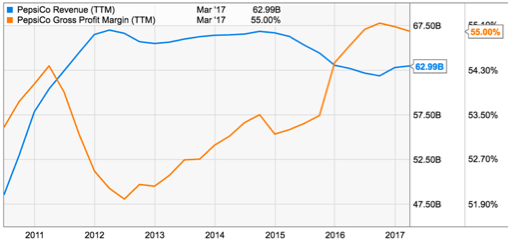

The revival of zero-based budgeting (ZBB), an approach that involves justifying expenses from a zero base for each new budget cycle, seems to be a common fiscal plan across the consumer goods industry. Other large companies that have traditionally been innovation leaders, including PepsiCo, Unilever, and Kellogg, are falling prey to the lure of cost savings.

As companies are drawn to attractive, short-term profitability gains, this inward focus risks losing sight of the company’s sustainable growth and the company’s strategic strengths. Below we identify four common, unintended consequences that result from this shift in perspective, and what can be done to avoid these pitfalls.

1. Inward Focus

Focus on recreating a budget every year can drive an organization to focus internally on saving money rather than needed growth. As a result, attention can drift away from understanding the customer or the changing marketplace.

It is this type of inward focus that causes companies to become victims of disruption: Dannon’s scramble after Chobani broke into the Greek yogurt market, Blockbuster’s fall to Netflix, and countless brand struggles resulting from Amazon’s stronghold in online retail.

While managing a new budgetary process with high scrutiny like ZBB can create a fiscal burden, it is important that the burden not be felt by individuals trying to deliver projects. Companies will need dedicated resources to manage the process, which may initially require additional overhead, but in the long run, will help prevent key contributors from losing sight of the core responsibilities that drive growth.

2. Playing it Too Safe

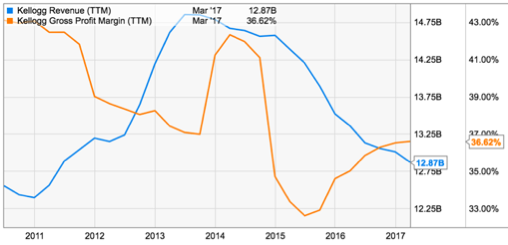

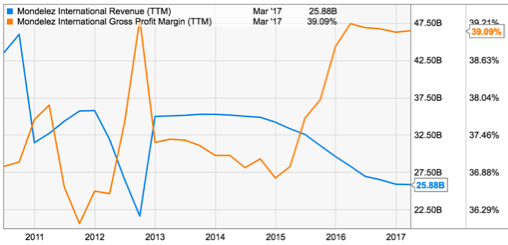

Most of the “wins” that come from the cost-cutting game are seen by shareholders. With stock performance as the main driver, it’s far too easy to throw out expenses that risk jeopardizing share prices. Kellogg, for instance, is experiencing a decline in revenue, similar to P&G, as a consequence of its excessive focus on cost-cutting. In FY2016, net income was up 13% year-over-year, but net sales saw a decline of 3.7%5. This pattern of stagnant or declining revenue, coupled with increasing margins, is not uncommon for companies who have taken on ZBB in recent years (Figure 2).

|

|

|

Figure 2: (From left to right) Revenue v. Gross Profit Margin for Kellogg, Mondelez, and PepsiCo6

If a company expects sustainable growth driven by innovation, it must support risk taking, exploratory efforts and potential failure from R&D. On a broader scale, this requires investing at least some of the cost savings back into the organization to fuel growth. More specifically, this can mean establishing a “slush fund” for R&D to pursue risk or exploratory efforts – which directly opposes the ZBB concept.

3. Driving Out Key Contributors

In today’s rapidly changing economic environment, people are a company’s most valuable asset in navigating the uncertainties of the future. When driving down costs becomes the primary focus for a company, two groups of key contributors are in danger of being driven out.

The first group, digital pioneers, creators and futurists, are the people who can drive future growth. However, they are usually the first to go when the innovation spark is drained out of a company, often followed by the budget that supports their work. While there is no replacement for proprietary, dedicated individuals, a company can, at least partially, fill this gap through outsourcing and open innovation.

Another group generally recognized as necessary to the organization – those responsible for quality, safety, regulatory, and IT systems – are most appreciated, and sometimes first noticed, when they prevent disasters from happening. In the absence of failures, however, their roles may appear to be unnecessary overhead. In looking to cut costs, these positions often get cut or roles are consolidated, causing systems to deteriorate over time. Without these critical functions in place and staffed for success, a company can be in dire straits when something goes awry.

It may be no coincidence that Kellogg, which cut 7% of jobs from 2013-20177 when it implemented its “Project K” cost-cutting initiative, has had two major food safety recalls in the past year, compared to a relatively clean track record in prior years8.

4. Cutting Multi-Year Initiatives

Starting from zero each year with the ZBB approach can often make short-term projects a priority in order to realize quicker stock gains. This can result in multi-year projects, with longer term potential and pay-out, ending up on the chopping block.

While it’s easy to blame cost-cutting measures for bringing long-term initiatives to a halt, the real issue is often a lack of a strong portfolio strategy and review process to support the new ZBB approach. The budget should not be determined on numbers alone; rather, it should be balanced across a strategy that delivers both today and the future. Today’s business environment might require aggressive cost savings, but if that is the only strategic focus, companies can quickly run into challenges. A robust portfolio review process balancing budget, risk, and strategic objectives helps prevent cutting initiatives beyond cost savings.

The bottom line is that while market pressures may force management into thinking ZBB or other cost-cutting initiatives are the only answer to maintain margins, these strategies don’t come without risks. Controlling costs is important, but making cost cutting the primary focus can lead companies astray and create a high risk of ultimate failure. A balanced approach is needed, and care must be taken to mitigate the unintended consequences of playing the cost-cutting game.

4. Data from YCharts.com

6. Data from YCharts.com